ABOUT THE SURVEY:

In September of 2019, Redtail Technology conducted the AdvisorComms 2019 Survey to better understand how financial advisors and their staff are communicating with clients and prospects, and how these communication channel and content choices affect client engagement. Redtail surveyed more than 3,200 wealth management professionals across the United States on the communication challenges they face, perceived client engagement across various channels, and the types of content they are sharing with clients and prospects (as well as their approach to tailoring that content).

Based on data collected from the survey, Redtail set out to understand:

- How wealth management professionals are communicating with their clients and whether there are opportunities to scale their practice by incorporating underutilized communication channels.

- The level of tailored content offices are sharing with their clients and prospects.

The challenges faced by advisors with regard to client communication.

METHODOLOGY:

Redtail surveyed over 3,200 wealth management employees across the United States, whose firms’ managed client assets ranged from $100 million to more than $1 billion. Among the respondents, the breakdown of roles was as follows:

- 51.1% administrative employees of financial advisory firms

- 37.3% financial advisors or financial planners

- 7.6% leadership of financial advisory firms

- 1.5% technical support within financial advisory firms

To gain a better understanding of how firms budgeted for communications, respondents were asked what the majority of their communications budget was being spent on this year. The top five budgeted items, accounting for 90% of all respondents, were as follows:

- Upgrading tools, technologies or processes: 33.8%

- Improving the quality of existing communication assets: 26.3%

- Engaging more on social media: 13.0%

- Hiring dedicated staff: 10.6%

- Launching new communications campaigns: 9.4%

KEY FINDINGS:

Advisors are largely relying on, or limiting their practices to using, the “traditional” methods of communication with their clients, such as in-person meetings and phone calls:

Firms are confident in both the value and engagement levels of in-person meetings and phone calls.

- When it comes to generating engagement from clients, in-person meetings (76%) and phone calls (66%) were ranked highest.

- 97% of respondents viewed in-person meetings as the most valuable form of communication, followed by phone calls at 93%.

Some widely used communications technologies are underutilized or not used at all by respondents

- Well over half (59%) of respondents are not communicating with clients via video, and only 7% are utilizing video to connect with clients on a regular basis.

- Nearly 87% of respondents think their clients would like to communicate with them via text, but 29% have a “no client texting” policy within their office. Further, nearly 41% of respondents have not been approved by their BD for texting with their clients.

Advisors are overlooking opportunities to tailor their communications:

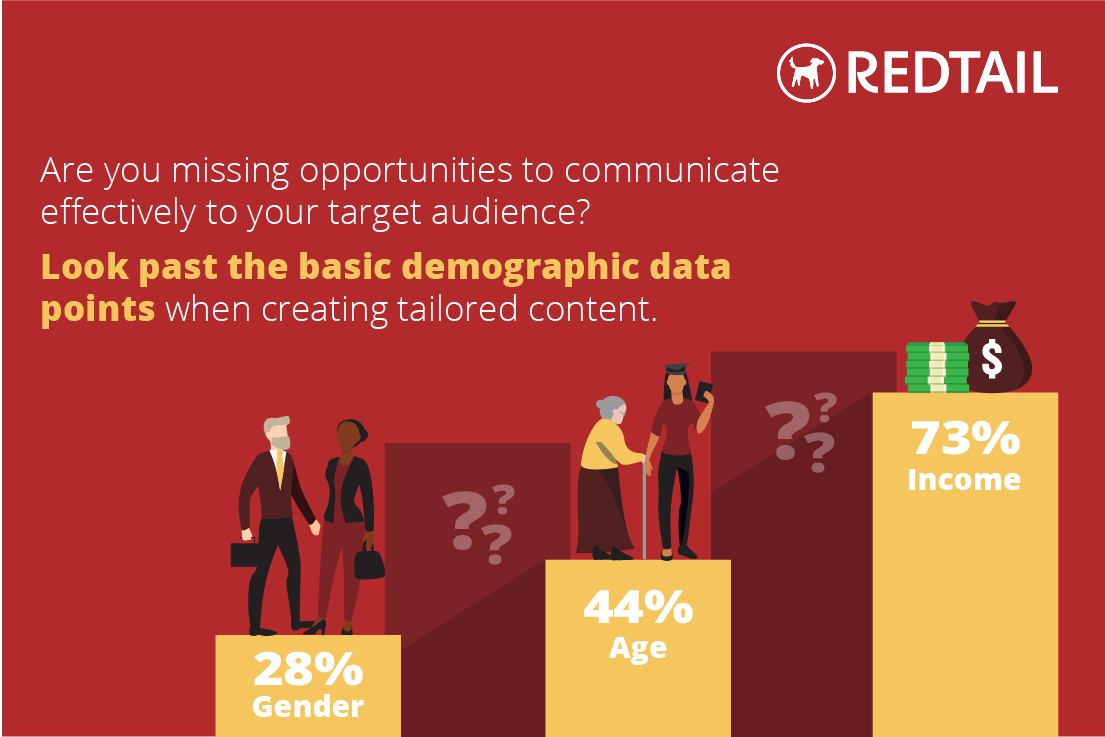

22% of respondents indicated their offices do not tailor content to their clients at all. Of those who do:

- Less than 6% consider any client characteristics outside of age, income, gender or education for the purpose of crafting tailored client content.

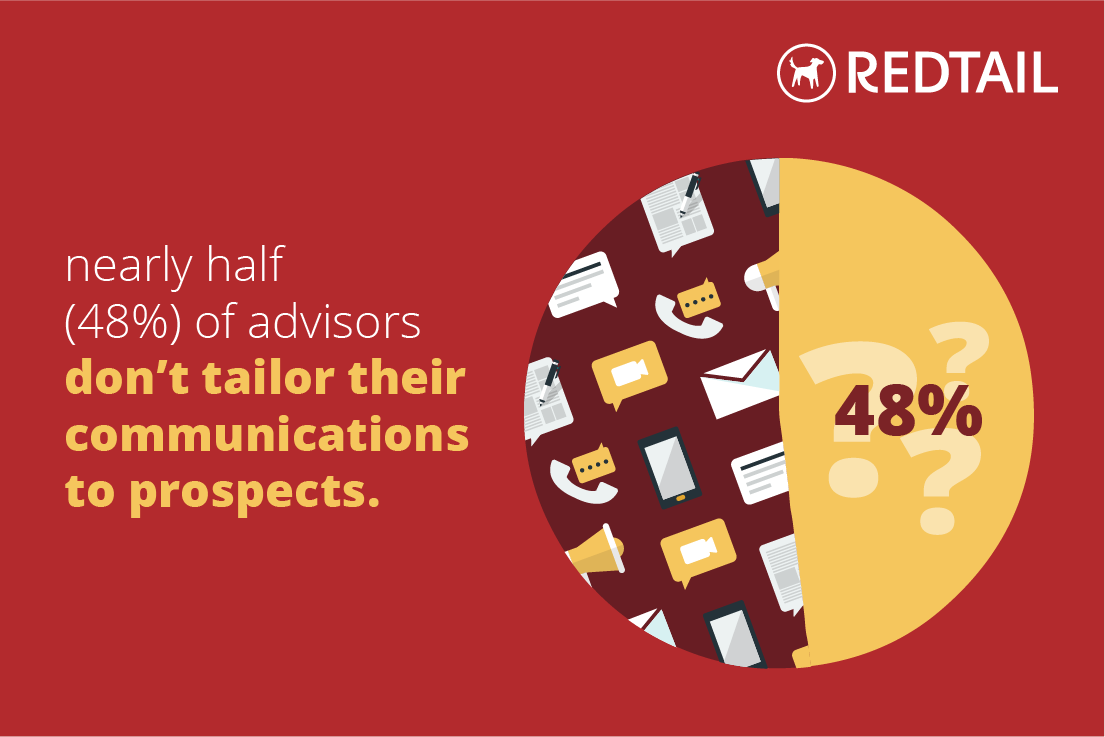

- Nearly half (48%) of respondents do not tailor communication to prospects.

- Only 52% of respondents indicated they communicate with clients’ families.

The top communication challenges indicated by respondents largely tracked with our above key findings:

Their top five challenges with client communication are:

- Customizing communication for different clients – 45%

- Engaging clients outside of meetings – 40%

- Producing unique content – 30%

- Producing consistent content – 28%

- Client unavailability – 28%

FURTHER ANALYSIS:

Traditional Communication Channels vs “New” Communication Technologies

While it may be comfortable to rely on tried and true methods of communication such as in-person meetings and phone calls for the majority of client interactions, leveraging technology that is widely embraced by the average consumer, such as video calls and texting, can help advisors navigate around issues like fee compression as they are able to increase their availability and scale their practices more effectively.

Two of the top five communications challenges respondents named were 1) engaging clients outside of meetings and 2) client unavailability. Two of the communications channels (texting and video/remote meetings) respondents currently aren’t utilizing to the fullest potential offer ways to address these challenges.

Our results showed right at half of respondents find text messaging valuable; we can also infer from our results that a large percentage of those rating texting as “Not Valuable” are likely not using texting as a communications channel, as nearly 41% have not been approved for texting by their Broker Dealer. As we’ve seen in numerous studies though, response rates for texts are much higher than those for emails (or phone calls that go unanswered), marking texting as a potential inroad for tackling the challenge of engagement outside of client meetings. After all, 87% of respondents believe their clients want to be able to text with them, but, to this point, that desire is largely not being filled.

Similarly, 59% of respondents are not communicating with their clients via video. If client unavailability is one of their biggest challenges, it’s certainly worth considering video / remote meetings as an offering firms might want to make available, particularly for those with a more geographically diverse client base or in areas or with clients where transportation might sometimes pose difficulties.

Overlooked Opportunities for Tailoring Communications

As we stated in our key findings, less than 6% of respondents consider any client characteristics outside of age, income, gender or education for the purpose of crafting tailored client content. Considering the technologies we know they are using to run their practices, including CRM (which allows them to track virtually unlimited key characteristics about each of their clients and prospects), an opportunity presents itself here both in terms of 1) strengthening client relationships (through more personalized communications to display an advisor’s attention to detail and level of care) and 2) addressing their number one named challenge: customizing communication for different clients.

Further, tailored content that touches upon key characteristics over and above the largely demographic information currently used should also help with the number two top challenge (discussed above), which was engaging clients outside of meetings, and that’s regardless of the communications channel used for delivering more finely tuned tailored content. Both clients and prospects want to feel like they are more than their demographics alone, and communications that reflect their advisor is interacting with them as an individual can bolster their confidence in the relationship.

CONCLUSION:

Both clear cut communication challenges and potential methods of meeting those challenges head-on arose through our examination of the survey results. Encouragingly, 60% of respondents are using their communications budgets for the year to update their tools, technology or processes and/or to improve the quality of their existing communications assets. While the survey didn’t drill down to the granular level about the nature of these updates and improvements, a clear majority of respondents do seem to be budgeting for communications with an awareness they need to either 1) incorporate new communications tools or 2) better use the ones they currently have.

“Due to the nature of the industry, particularly in terms of its regulation, financial services is often significantly slower than others to embrace new communication technologies. That said, we weren’t surprised by how much advisor offices still rely on phone calls and face-to-face meetings; what did surprise us was how little they appear to be incorporating alternate forms of communication that might be better suited for specific types of outreach while also helping them to address some of their biggest challenges. We set out to dig into this divide and came away with what we consider to be a wealth of actionable insights we can share with advisors.

“Our research indicates opportunities abound for offices in terms of scaling their practices and honoring client communication preferences; in many cases it may be as simple as retooling their usage of available communications technologies. Additionally, the results lead us to conclude advisors may not be taking advantage of opportunities to strengthen relationships through more precisely tailored content to clients and prospects. In a competitive market, taking advantage of either of these opportunities should produce dividends.”

Brian McLaughlin, CEO of Redtail Technology

WINNER:

Congratulations as well to survey participant Jason out of Smithtown, NY, who won the drawing for a $250 Amazon Gift Card.

——————————-

For more information on the survey findings or if you have any questions about Redtail Technology, please contact Kimberly Beck | kimberly.beck@redtailtechnology.com.